How to Align Your Ambition, Investors, and Execution?

The Three Swimlanes - which one is yours?

In 2021, informal deep-dive sessions in a Parnell flat gave rise to a thriving community of Kiwi founders.

Many of these startups have since raised over $10 million and are hiring now, contributing significantly to New Zealand's burgeoning entrepreneurial landscape. At Phase One, a goal we have is six unicorns, and we are well on track. But that is just a metric - the real story is having more big Kiwi entrepreneurial wins which inspires even more to get going. A core reason for our founders' success? A strong hypothesis on their 'why.'

Introduction to the Framework

Entrepreneurship is an endurance game. It's not just about building a great loved product; it's about having the endurance, grit, and clarity of purpose to go the distance. Execution, timing, customer obsession, and product-market fit all play crucial roles, but the primary step is understanding your personal 'why.' What impact do you want to create in your life through your entrepreneurial journey?

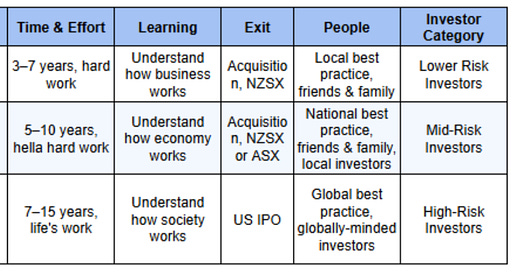

This framework helps founders define key aspects of their entrepreneurial path:

Your Why: Grappling with your personal motivation is crucial. It drives your decisions and keeps you focused during challenging times. Ask yourself: What do I want to achieve personally from this venture? What is my personal story? Outside of my venture - what is the impact I want to have with the learnings, network and capital that I earn?

Venture Why: Align your venture's mission with your personal goals. Determine the primary objective of your business, whether it's financial freedom (swimlane 1), hybrid of financial freedom and setting new benchmarks (swimlane 2), or a more abstract larger than life societal impact (swimlane 3).

Value: Estimate the potential value of your business at the time of a significant milestone (a clear potential exit option). This projection will be a guide for team, investor engagements. It allows for a clear hypothetical milestone.

Time & Effort: Assess the level of commitment required. Different ventures demand varying degrees of time and effort. Ensure your commitment aligns with your personal and professional life expectations. Often it is actually about what you are willing to give up.

Learning: Consider the knowledge and skills you will gain. Each venture offers unique learning opportunities that can contribute to your personal and professional development. Invariably the more singularly you focus on your venture the more you will learn from the journey.

Exit: Allows for some planning. Whether it's an acquisition, public listing, or another route, having a exit milestone helps in setting long-term goals. This is a hypothetical but given the type of swimlane you have chosen - believable exit point. You will reassess as you close in on that milestone.

People & Investors: Identify the type of team and investors that align with your venture's goals. The right partners can provide not only capital but also valuable expertise and networks.

Diving into the Swimlanes!

Swimlane 1: Master of My Own Time

Example: John’s Equestrian E-Commerce Venture

John, an experienced entrepreneur, identified an opportunity in the equestrian market to streamline the supply chain for pet food and medicine. Over seven years, he built a significant revenue-generating business with a dedicated team of 15. Eventually, he listed the company on the NZX or sold it to a global pet food giant.

Key Factors:

Personal Why: Achieve personal freedom and financial security, allowing for contributions to society and exploration of other interests.

Venture Why: Focus on revenue generation and profits.

Value Created:100M.

Time & Effort: 3-7 years of dedicated work with flexibility.

Learning: Gain deep expert level insights into company and business scaling - you are able to solve any problem that could occur within a business, customers and market

Exit Strategy: NZX listing or local acquisition.

People & Investors: Collaborate with professionals seeking balanced lifestyles and engage with lower-risk investors such as banks and industry experts, targeted angels, corporations.

Swimlane 2: Making Regional-Level Change

Example: Asha's Hospitality Procurement Platform

Asha identified significant inefficiencies in the procurement processes of large hospitality chains across Australia and New Zealand (ANZ). Recognising the fragmented supply chains and resulting cost inefficiencies, she developed a platform to optimise procurement for hotels, starting with bedware and expanding into bathroom goods, food and beverages, and eventually owning parts of the supply chain. Over a decade, Asha scaled her company to a $300 million valuation, listed it on the Australian Securities Exchange (ASX), and built a team of 100 professionals. With her financial success, she reinvested in her hometown of Dunedin, supporting training programs for youth and improving rural healthcare access by establishing a trust to address general practitioner shortages in farming communities.

Key Factors:

Personal Why: Gain a deep understanding of regional economies, including how policy, financial cycles, and various businesses interact. Leverage this knowledge and the connections made to direct capital toward meaningful regional change, benefiting local communities and industries.

Venture Why: Set dual key performance indicators (KPIs): a specific revenue target and a mission to become best-in-class within the region. This approach ensures both financial success and a commitment to excellence in service or product offerings to the customer.

Value Created: $300M business created when you exited

Time & Effort: Dedicate 5 to 10 years of significant commitment to build and scale the venture, requiring perseverance and strategic planning.

Learning: Develop a deep understanding of regional economies, including micro and macroeconomic policies, regulations, and market cycles. This knowledge positions you to navigate and influence the regional business landscape effectively.

Exit Strategy: Consider listing on regional stock exchanges like the NZX or ASX, or explore regional mergers and acquisitions (M&A) as potential exit strategies, aligning with the venture's regional focus.

People & Investors:

Team Members: Assemble individuals committed to driving regional change, focusing on becoming the best in class within the national context. These team members should possess a deep understanding of local market dynamics and a passion for regional development.

Investors: Engage mid-risk, mid-return investors who have experience in scaling businesses and are willing to back high-potential ventures based on prior successes. These investors often have a vested interest in regional development and can provide valuable insights and resources. Corporate investors are also a right fit early on.

Swimlane 3: Transforming an Industry

Example: Chloe and Jan's Mining Optimisation Startup

Chloe and Jan identified inefficiencies in the Australian mining sector, where machine breakdowns led to significant productivity losses. They developed an asset management tool to monitor equipment failures, provide diagnostics, and facilitate rapid resolutions. After two years of intensive industry research, they launched a product that gained global traction. Within 12 years, their company achieved 3 billion in revenue and went public with a 30 billion valuation on the Nasdaq, employing 2,000 people, including 1,000 based in Auckland.

Key Factors:

Your Personal Why: You wanted to ensure there was no waste in the mining and earth intrusion industries. This had a significant eco-impact and ensured there were huge gains for the world across many areas.

Venture Why: Aim for global industry-wide transformation as the primary story.

Value Created: $2 billion and above.

Time & Effort: 7-15 years of singular focus and dedication.

Learning: Gain a comprehensive understanding of society, including product, growth, capital, politics, policy, commerce, culture, human behavior, and governance.

Exit Strategy: U.S. IPO or global mergers and acquisitions.

People & Investors:

Team Members: Individuals striving to be best in class globally, fully dedicated to achieving world-scale impact.

Investors: High-risk, high-return investors experienced in high-stakes ventures and capable of identifying repeatable success patterns.

Note - its different for B2C vs. B2B Startups

Building a beloved product at scale for end consumers (B2C) is exceptionally challenging yet highly rewarding. Consumers have unpredictable preferences, making the path to success less straightforward. However, consumers represent a significant portion of the global economy. If a founder can create a product adored by consumers, it can lead to valuations of $100 billion or more (e.g., Uber, Facebook, Instagram). Achieving this requires a deep understanding of customer behavior, relentless focus on experience, and the ability to address mass-market needs globally.

In contrast, B2B ventures cater to businesses with rational, well-defined value propositions. These ventures focus on delivering measurable outcomes, such as cost savings, improved efficiency, or compliance. B2B companies often succeed by addressing niche needs within specific industries and scaling effectively through key functions such as human resources, finance, and procurement. The rational nature of B2B ventures typically makes their growth more predictable and their scaling more structured.

Important lens to have when you are thinking about the swimlanes and the variables noted above. Deep tech, marketplaces and other startup business models - all have differ a little bit.

Also note note services businesses would be predominantly swimlane 1 with some moving into swimlane 2. For a services business to hit swimlane 2 - it’s going to take a long time.

Right Fit Investors

Understanding investor fit is crucial for aligning your venture's goals with the appropriate funding sources.

Swimlane 1 and Most of Swimlane 2: Traditional growth investors, angels, and strategic partners are often better aligned. Pure-play venture capital firms, which focus on high-risk, high-return bets, may not be the right fit here.

Swimlane 3 and Select Swimlane 2 Ventures: These ventures are best suited for venture capital funding. The initial investment decisions for VCs are often based on conviction rather than evidence, as startups at this stage lack clear data to justify the risk.

For investors to bet with conviction, experience in navigating and benefiting from such high-risk, high-reward bets goes a long way. Those who have reaped the rewards of these risks are arguably even better equipped to hone their signal-reading abilities, identifying promising opportunities. Simply put - the more wins we have the more pro-risk we become in New Zealand the braver we are about the bets we make….the more we win. A self fulfilling prophecy.

Only the last swimlane and parts of the second swimlane technically represent startups. According to Paul Graham (founder of YC), a startup grows at ~5% week on week. This exponential growth aligns with venture capital’s high-risk, high-reward model. Swimlane 1 is a local game, Swimlane 2 a regional game, and only Swimlane 3 is global. It is really important to note that none of the swimlanes are better than the other. The goal is to win, and you win when you play the game you want to play.

*from Paul Graham’s Startup = Growth essay

Right Fit Team

The demands of your team should match the ambition of your venture.

Swimlane 1: Team members are professionals seeking high-performance but balanced lifestyles, fostering a family-like atmosphere.

Swimlane 2: Team committed to regional change, focused on becoming the best in class nationally. There is a heightened level of focus, clarity and sacrifice. You are known for national best practice.

Swimlane 3: Those striving to be best in class globally, fully dedicated to achieving world-scale impact. More sports team-esque with iconic culture vibes. You are seen as a global high achiever re:talent and outcomes.

Across all swimlanes, the initial culture, caliber, and investment look similar in the early days. However, within the first two years, the standards founders set determine the outcomes. Clarity of ambition and expectations is what delivers meaningful results. Great culture is clear culture.

What Happens If You Are Not Clear About Your Why?

If you aren’t clear about your personal why, you risk misaligning your venture, investors, and expectations, leading to fundamental challenges in your startup journey. Here’s what can happen:

Building the Wrong Business for You

Without a strong why, you may end up pursuing a business that doesn’t align with your long-term goals. You might build a high-revenue company early when your real ambition was global industry disruption which required more problem/product discovery early —or vice versa. Misalignment leads to burnout, regret, and missed opportunities.Misalignment with Investors

If you don't understand where your venture fits (local, regional, or global), you may engage with the wrong type of investors.A Swimlane 1 founder taking VC funding might be nudged to scale too fast.

A Swimlane 3 founder backed by traditional growth investors might lack the high-risk capital, support and patience needed for exponential growth.

A Swimlane 2 venture trying to act like a Swimlane 3 startup may get caught between too much ambition and too little capital, leading to stalled momentum.

Struggling to Hire the Right People

Your talent strategy needs to match your ambition level. If you're unclear about where you are headed:You may hire too conservatively for a high-scale business, leading to execution bottlenecks.

Or, you might overhire experienced talent too early, burning cash before product-market fit.

Culture also suffers—early clarity around ambition sets expectations for execution, pace, and standards.

Inefficient Execution & Strategy Drift

If you lack clarity on your personal and venture why, decision-making becomes reactive, not intentional.You waste time pivoting between ideas because you don’t own your swimlane.

You chase short-term wins over long-term positioning.

You get distracted by external noise (e.g., funding rounds, PR hype, competitors), instead of executing a clear roadmap.

Increased Risk of Founder Burnout

When you don’t have a clear why, you’re grinding without a mission. Even if the company does well, you might find yourself resenting the path you’ve chosen.Without clarity, success feels hollow.

Without alignment, motivation drops.

Without purpose, resilience fades.

How to Fix It?

Start by choosing your swimlane intentionally. Your personal ambition should drive your venture strategy, not the other way around. Align vision, execution, and capital to build the right company for you.

And it’s ok—you can change your mind. Although the longer you go on a swimlane, the harder the preceding swimlane becomes.

Conclusion and Summary

Understanding your personal 'why' and aligning it with the appropriate swimlane ensures that your ambition, investors, and execution are in harmony. This alignment is crucial for long-term success and personal fulfillment in your entrepreneurial journey. By intentionally choosing your swimlane, you can build a venture that not only achieves your business goals but also resonates with your personal aspirations. Stay lean, stay problem-obsessed, and build something people love. We got this—let’s grow this awesome New Zealand ! Come on! 🚀

Great article Mahesh! Can you share your thoughts on how thinking about the swim lanes differ for a B2B business as alluded in your article?